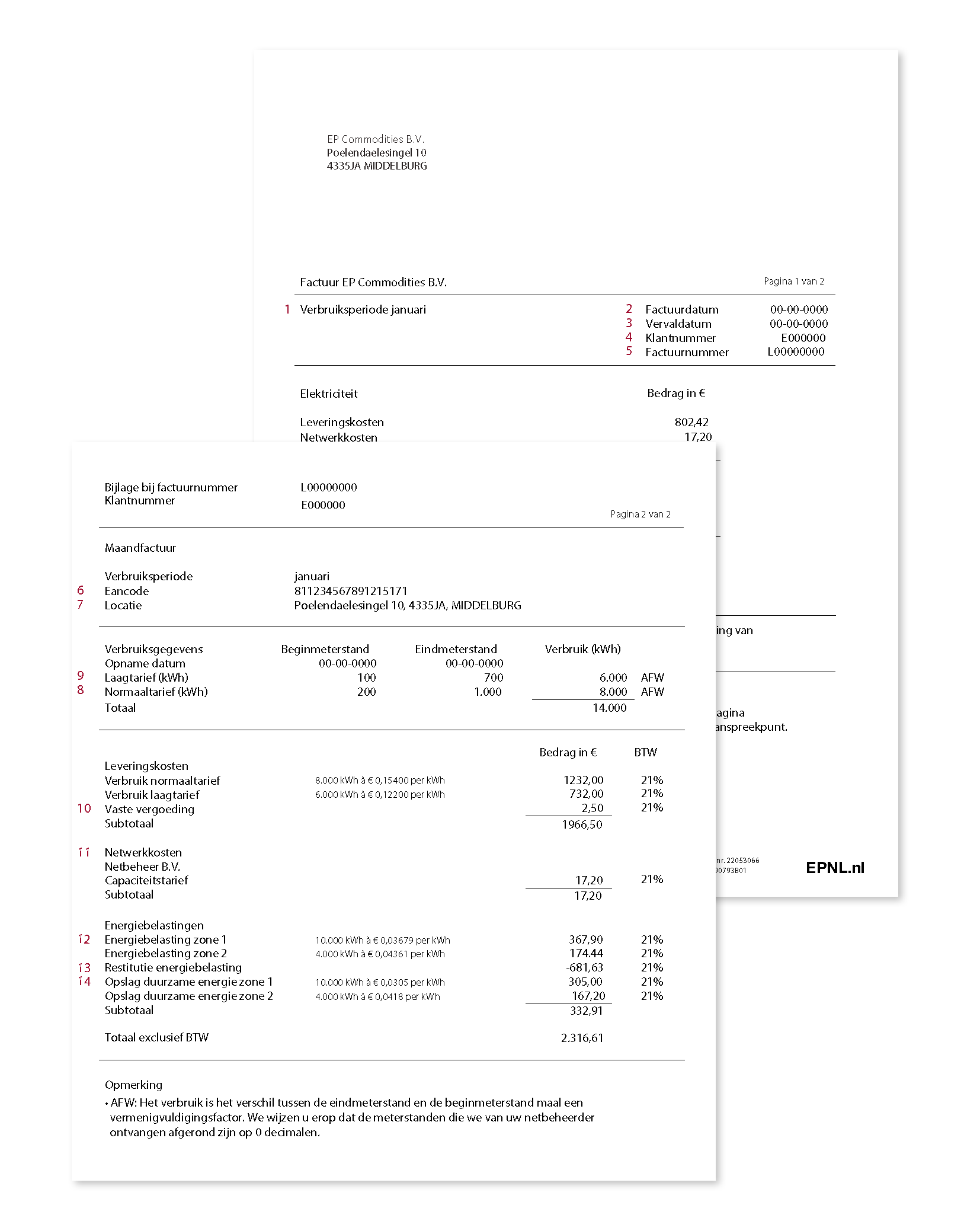

Overview Monthly invoice

Every month you will receive a detailed bill from us for your consumption of electricity and/or gas, also known as the monthly bill. We understand that you may have questions about the details of your bill. That is why we explain here, step by step, what information you can expect.

Our brochure provides a clear explanation of your monthly bill and answers common questions. It describes what information appears on the invoice and how to interpret it. You can view the brochure directly below or download it for later use.

Maandfactuur

Uw Maandfactuur Uitgelegd

Your monthly invoice explained

- Location

The physical location(s) where energy has been supplied. Multiple locations may be listed on one invoice. - Consumption period

This period indicates when the energy products and services were delivered. - Invoice date

This is the date on which the monthly invoice was generated. - Due date

The latest payment date of the invoice. - Customer number

Your unique identification number. - Invoice number

This unique number serves as the reference code and payment reference for the monthly invoice. - EAN (European Article Number) code

An 18-digit number identifying your specific electricity or gas connection, including country code and network operator.

- Standard rate hours (Peak)

These are the hours when the standard rate applies. There are two options: from 07:00 to 23:00 or from 08:00 to 20:00 on working days. If you are billed on an advance payment basis, the annual consumption on which this advance payment is based is shown here. - Low tariff hours (Off Peak)

These are the hours when the low tariff applies. The times can range from 23:00 to 07:00 or from 20:00 to 08:00. Low-rate hours also apply on recognised public holidays and weekends. - Fixed fee

A fixed amount charged each month, regardless of energy consumption. - Network charges

Charges we charge on behalf of the network operator (applicable to small consumption only).

12. Energiebelasting

this tax is levied by the government and calculated on the basis of monthly consumption. Energy tax rates are adjusted annually and vary by consumption zone. For advance invoices, the tax is calculated pro rata to the consumption zones.

13. Energy tax refund

An annual energy tax refund applies to certain electricity connections. For connections with residential function this is € 521.81 (excluding VAT), otherwise the refund is € 0.00 per year.

14. Renewable energy storage

This government surcharge on the consumption of electricity and gas is designed to encourage renewable energy production and is set annually.

FAQ

-

Our company’s billing address changes. How do I report this?

You can communicate your changed billing address via the contact form on our website.

-

I would like to pay by direct debit. How do I arrange this?

You can sign up for direct debit via the contact form on our website.

-

When will I receive my annual statement?

You will receive your annual statement at the beginning of the first quarter after the supply year, if you receive monthly advance bills.

-

How are EB and ODE calculated if I feed back to the energy grid?

This depends on the type of connection. With a small consumer connection, netting takes place. This means that the feed-in is deducted from the supply. You only pay EB and ODE on the remaining supply (consumption). If the feed-in is higher, you do not pay any EB and ODE. This balancing scheme does not apply to high-volume connections.

-

What is the capacity tariff?

The capacity tariff is a fixed transmission charge for small consumer connections. The larger the connection, the higher the tariff.

-

Why transport costs are mapped

Transport charges are levied for maintaining the networks and transporting your energy.

Transmission tariffs are set by the Authority Consumer & Market (ACM), the energy industry regulator. These tariffs consist of a fixed and a variable part. You can consult the current transmission tariffs on the website of the Authority Consumer & Market.

-

When will I receive my monthly bill?

We invoice as soon as we receive the consumption data from your network operator. If we have not received any consumption data after 21 working days, we will estimate your consumption for the past month. In that case, you will receive an invoice based on this estimate.

On the eleventh working day of each month, EP NL receives your electricity consumption data from your grid operator. For gas, this is usually done on the sixth working day of the month. -

Are all connections billed separately?

If you have multiple connections within the same supply contract, there are different billing options:

It is important that you indicate which billing method you prefer. You can easily communicate this via the Contact form.

-

When is there an accommodation function?

A residential function exists when the connection is located in a building where people can live and/or work.

For a complete overview, please visit our residential function page. -

How do I request a copy of my invoice?

You can easily download a copy of your invoice via My EP NL.

My EP NL is our online environment where you can easily arrange many things at your convenience.Through My EP NL you can:

-

Is there a residential function?

A residential function exists when the connection is located in premises intended for residential and/or work activities.

-

Why is energy tax charged?

Energy tax discourages high energy consumption, helps achieve climate goals, and contributes to fossil fuel costs and emissions.

-

When am I entitled to energy tax reduction or exemption?

Under certain conditions, you may be entitled to a lower rate or even exemption from energy tax.

On our website, you will find more information on the most common reasons why you, as a business energy user, may be eligible for an energy tax reduction or exemption.

Do you want to know whether you qualify for this or download a statement? Then go to Energy Tax Declarations. -

Why is energy tax charged?

The government levies energy tax on the consumption of electricity and gas to reduce energy consumption. This tax aims to reduce the use of fossil fuels, reduce greenhouse gas emissions and combat acidification. By raising the price of energy, the government hopes consumers will be more conscious and economical with energy.

-

Why do I receive an advance invoice every month?

If you do not have a telemetry meter, or if we only receive the consumption data from your network operator once a year, EP NL will send you a monthly invoice based on a fixed advance payment.

At the end of the year, you will receive an annual statement, in which the actual consumption is settled -

Why do I receive an advance invoice every month?

If you do not have a telemetry meter, or if we only receive the consumption data from your network operator once a year, EP NL will send you a monthly invoice based on a fixed advance payment.

At the end of the year, you will receive an annual statement, in which the actual consumption is settled -

What is the difference between delivery charges and transport charges?

Transmission charges are the costs you pay to the grid operator for maintaining the networks and transporting your energy. These costs are set by the Authority Consumer & Market (ACM), the energy industry regulator.

Delivery charges are the charges you pay to your energy supplier for the actual delivery of energy. The rate for delivery is stated in your supply agreement

-

Why do we receive an invoice based on estimated consumption?

If we have not received any consumption data from your network operator after 21 working days, we will estimate the consumption for the past month. If an estimate has been made, this will be clearly stated on your invoice. As soon as we receive the actual consumption data from the grid operator, we will send you a correction invoice for the difference between the estimate and the actual consumption.

Want to know more about us?

Contact us via our contact page or find out more about our company on the about us page.